How to Buy Natural Diamonds as a Long-Term Asset: A Guide for Investors

Natural diamonds have long been cherished for their beauty and rarity, but they also hold significant potential as a long-term asset. Unlike volatile stocks or ever-changing fashion trends, high-quality natural diamonds can retain and even appreciate in value over time, making them a unique addition to a diversified investment portfolio.

Here’s a brief guide on how to approach buying natural diamonds with a long-term investment mindset:

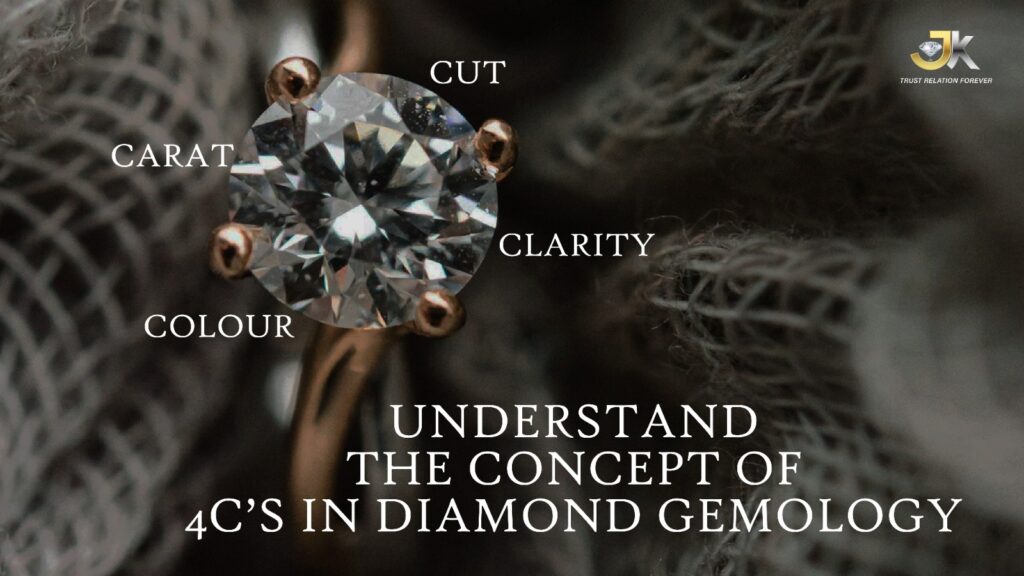

1. Understand the “4 Cs” and Beyond

The value of a natural diamond is primarily determined by the “4 Cs”:

- Carat Weight: Larger diamonds are rarer and generally more valuable. However, a larger carat weight alone doesn’t guarantee value if other Cs are lacking.

- Cut: This is arguably the most crucial factor for a diamond’s brilliance and sparkle. An excellent or ideal cut maximizes light performance, significantly enhancing its value.

- Color: Diamonds are graded from D (colorless) to Z (light yellow or brown). Colorless diamonds (D-F) are the most desirable and expensive. However, “fancy colored diamonds” (pink, blue, yellow, etc.) are a separate category, incredibly rare, and can command extraordinary prices.

- Clarity: This refers to the absence of internal inclusions and external blemishes. Flawless diamonds are exceedingly rare and highly valued. For investment, VS1-VS2 clarity often offers a good balance of beauty and value.

Beyond the 4 Cs, consider:

- Rarity: This is key for investment. High-quality, large, and naturally colored diamonds are inherently rare and their supply is finite, contributing to their long-term value.

- Provenance and History: Diamonds with a unique history or famous ownership can have added value.

2. Prioritize Certification from Reputable Labs

Always, always purchase a certified natural diamond. The certification from an independent, globally recognized gemological laboratory provides an unbiased assessment of the diamond’s quality and authenticity. The most trusted certifications are from:

- GIA (Gemological Institute of America): Widely considered the most stringent and reputable.

- IGI (International Gemological Institute): Also a good option, especially for commercial-grade diamonds.

- AGS (American Gem Society): Known for its precise cut grading.

These certificates act as a “passport” for your diamond, essential for verifying its value and ensuring liquidity for future resale.

3. Focus on Investment-Grade Diamonds

Not all natural diamonds are suitable for investment. For long-term appreciation, look for:

- Larger Carat Sizes: Diamonds of 1.00 carat and above generally have better resale potential.

- High Quality in the 4 Cs: Focus on excellent cut, near-colorless or colorless grades (D-G), and high clarity (VS1-VS2 or better).

- Timeless Shapes: Round brilliant, oval, and emerald cuts tend to have consistent demand.

- Fancy Colored Diamonds (with caution): While potentially offering extraordinary returns, these require specialized knowledge and can be highly illiquid. This area is generally for expert investors.

4. Work with a Reputable Jeweler or Dealer

Choose a trusted seller who offers transparency, educational resources, and proper documentation. A knowledgeable jeweler can guide you through the selection process, explain the nuances of diamond grading, and ensure you receive a genuinely certified stone. Avoid deals that seem “too good to be true.”

5. Think Long-Term and Manage Expectations

Natural diamonds are not a liquid asset like stocks or gold that can be traded daily. They are best viewed as a legacy investment, meant to be held for years, even generations. Their value tends to appreciate steadily over time, acting as a hedge against inflation and a store of wealth. While they offer durability, lasting value, and emotional significance, they require patience for significant returns.

6. Consider Loose Diamonds Over Set Jewelry

For investment purposes, it’s often advisable to purchase loose diamonds rather than set jewelry. The value of jewelry includes the craftsmanship and setting, which may not contribute to the diamond’s resale value. Loose diamonds allow for a more direct assessment of the stone’s intrinsic worth and offer greater flexibility for future use or sale.

By understanding these key aspects, you can make informed decisions when acquiring natural diamonds, positioning them as a beautiful and valuable addition to your long-term asset strategy.

Stay updated on the latest JK Sons postings by following us on Instagram.

https://www.instagram.com/j_ksons/

https://x.com/jksonsdiamond?t=a4_K1Uej1BwNCXt63jmEMw&s=08

https://www.youtube.com/@JKSons-q4x

https://www.facebook.com/share/19fYjZtEZf/

https://www.linkedin.com/in/jk-sons-a8005832b?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=android_app